Money in Minutes - Short Term Personal Loan App 3.8

Free Version

Publisher Description

Money In Minutes is an online lending platform facilitating Personal Loan up to ₹2 lakh. All loan applications are approved and disbursed by NBFCs governed by RBI. Primary NBFC partners of Money In Minutes are – Unique Auto Finance & Leasing Pvt. Ltd. And Tushar Leasing & Investment Pvt. Ltd.

Product Brief

Money In Minutes offer short term loans ranging from ₹ 1,000 to ₹ 2,00,000

Minimum repayment tenure: 62 days

Maximum repayment tenure: 730 days (24 months).

Maximum Annual Percentage (APR): 21.5% to 69% depending on the risk profile of the customer and product availed.

Platform onboarding Fees (One Time): ₹350 ( Exclusive of GST)

Processing Fees: 3% to 15% of the loan amount. ( Exclusive of GST)

Example of the total cost of the loan Including all applicable fees, interest and taxes :

Loan Amount ₹ 10,000

Loan Tenure 90 Days (3 Months)

Platform onboarding Fees ₹ 350 + 18% GST = ₹ 413 4.13 % of loan amount

Processing Fees ₹ 300 + 18% GST = ₹ 354 3.54% of Loan Amount

Interest ₹ 900

Total Repayment ₹ 10900 ( Inclusive of GST)

Repayment Schedule Below-

EMI Monthly Interest Account Principal

1. ₹ 3633 ₹ 300 ₹ 3333

2 . ₹ 3633 ₹ 300 ₹ 3333

3 . ₹ 3633 ₹ 300 ₹ 3333

Money In Minutes is a Credit Platform & Personal Loan App for Young Professionals across India, where you can apply for Personal Loan Online & avail up to ₹2 Lakh as Direct money transfer to your Bank Account.

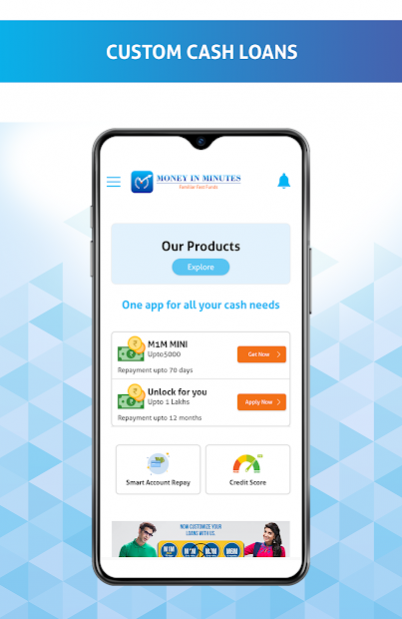

Loan Type-

Instant Personal Loan - A flexible loan option where you can avail of instant loans within 10 minutes as a direct bank transfer. Documents required are PAN Card & Address Proof to avail loan from 1000/- to 10,000/- for a tenure ranging from 62 days to 4 months.

Money in Minutes gives Emergency loans and loans for bad credit, with same day disbursal to salaried individuals to meet their short-term loan needs.

MIM Personal Loan – An unsecured form of credit where you can avail instant loans ranging from ₹10,000 to ₹2 Lakhs as a direct bank transfer. Its tenure ranges from 3 months to 24 months. Documents required to apply for a personal loan are PAN Card, Address Proof and Salary Account Bank Statement.

Features of personal loan

1. Quick and easy loan approval

2. 100 per cent online loan process

3. Fast loan processing and Instant bank transfer

Benefits & Risks

1. Users can get access to higher loan amounts & tenures when repayments are made as per the repayment schedule.

2. Repayment behaviour is shared with all the credit rating agencies, as directed by the Reserve bank of India.

Eligibility

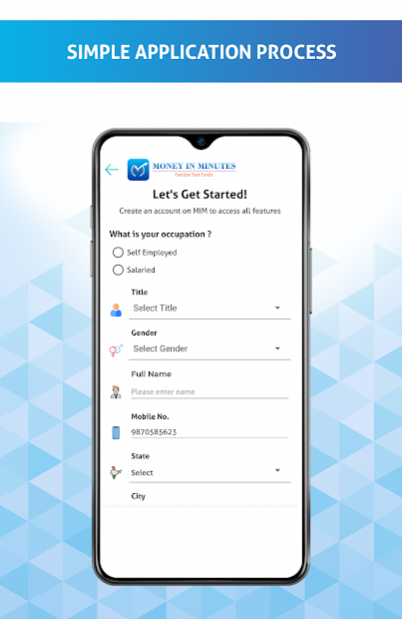

A salaried Indian resident above the age of 21 years, having a monthly source of income is eligible for a personal loan, installment loans, secured loans, emergency loans with Money In Minutes.

Application Process

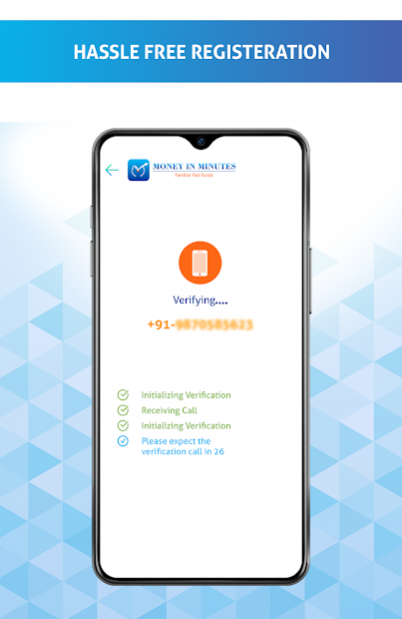

1. Install Money In Minutes Personal Loan App on your mobile

2. Register through Mobile Number

3. Fill in the basic details to check the first level eligibility

4. Upload KYC documents - ID, Address Proof & PAN card

5. Submit loan application

6. Get an Instant decision.

7. Disbursal of the loan directly into your bank account.

Contact Us-

1. mimcare@moneyinminutes.in

Address-

4A/36 2nd & 3rd Floor Tilak Nagar New Delhi 110018 India

About Money in Minutes - Short Term Personal Loan App

Money in Minutes - Short Term Personal Loan App is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops Money in Minutes - Short Term Personal Loan App is Money in Minutes. The latest version released by its developer is 3.8. This app was rated by 3 users of our site and has an average rating of 4.0.

To install Money in Minutes - Short Term Personal Loan App on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2021-04-09 and was downloaded 1,755 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Money in Minutes - Short Term Personal Loan App as malware as malware if the download link to moneyinminutes.in is broken.

How to install Money in Minutes - Short Term Personal Loan App on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the Money in Minutes - Short Term Personal Loan App is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by Money in Minutes - Short Term Personal Loan App will be shown. Click on Accept to continue the process.

- Money in Minutes - Short Term Personal Loan App will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.